Platform

Unify Every Banking Experience With a Digital Platform Built for More.

Deliver frictionless, connected banking experiences for both your customers and staff across every channel, self-service or assisted, digital or in-person.

One Platform. One Experience.

With Savana, self-service and assisted banking work as one. Our banking platform connects systems, workflows, and channels to create a seamless experience for both customers and staff. No more silos or friction, just a smooth and consistent journey across every touchpoint.

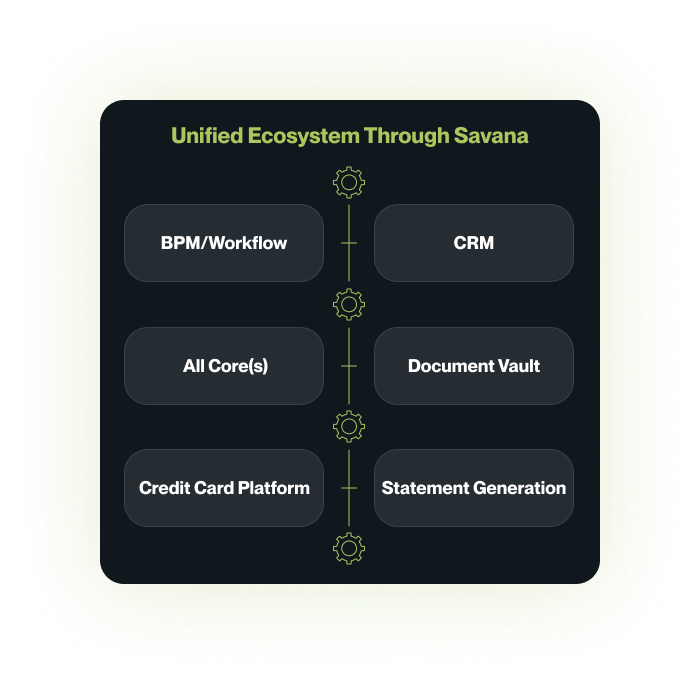

Everything Banking, Connected

Unify your banking ecosystem by connecting cores, channels, CRM, BPM, and third-party tools into a single, seamless platform. No more silos; just real-time data flow, automated processes, and built-in servicing tools like case management, document vaulting, and communications management to keep every process connected.

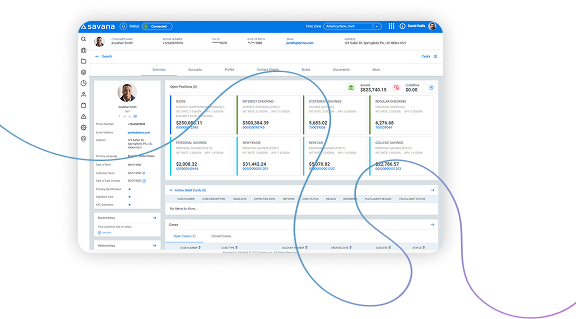

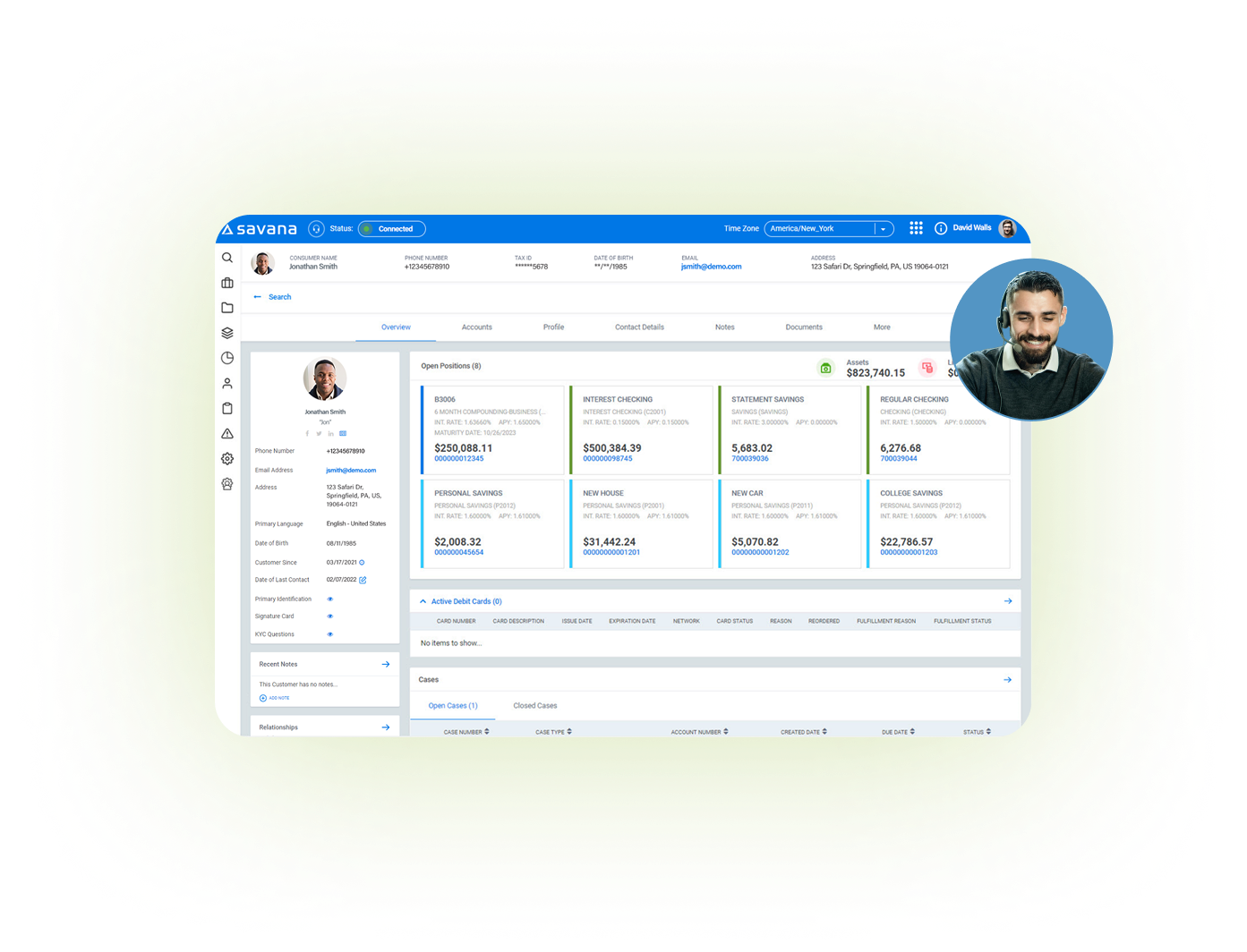

One Banker View

Give your team a complete view of every customer, from account history to real-time interactions, so every touchpoint feels personal, informed, and connected. Centralized servicing history, automated notifications, and real-time customer insights ensure your staff always has the full context across contact center, back-office, branch, and more.

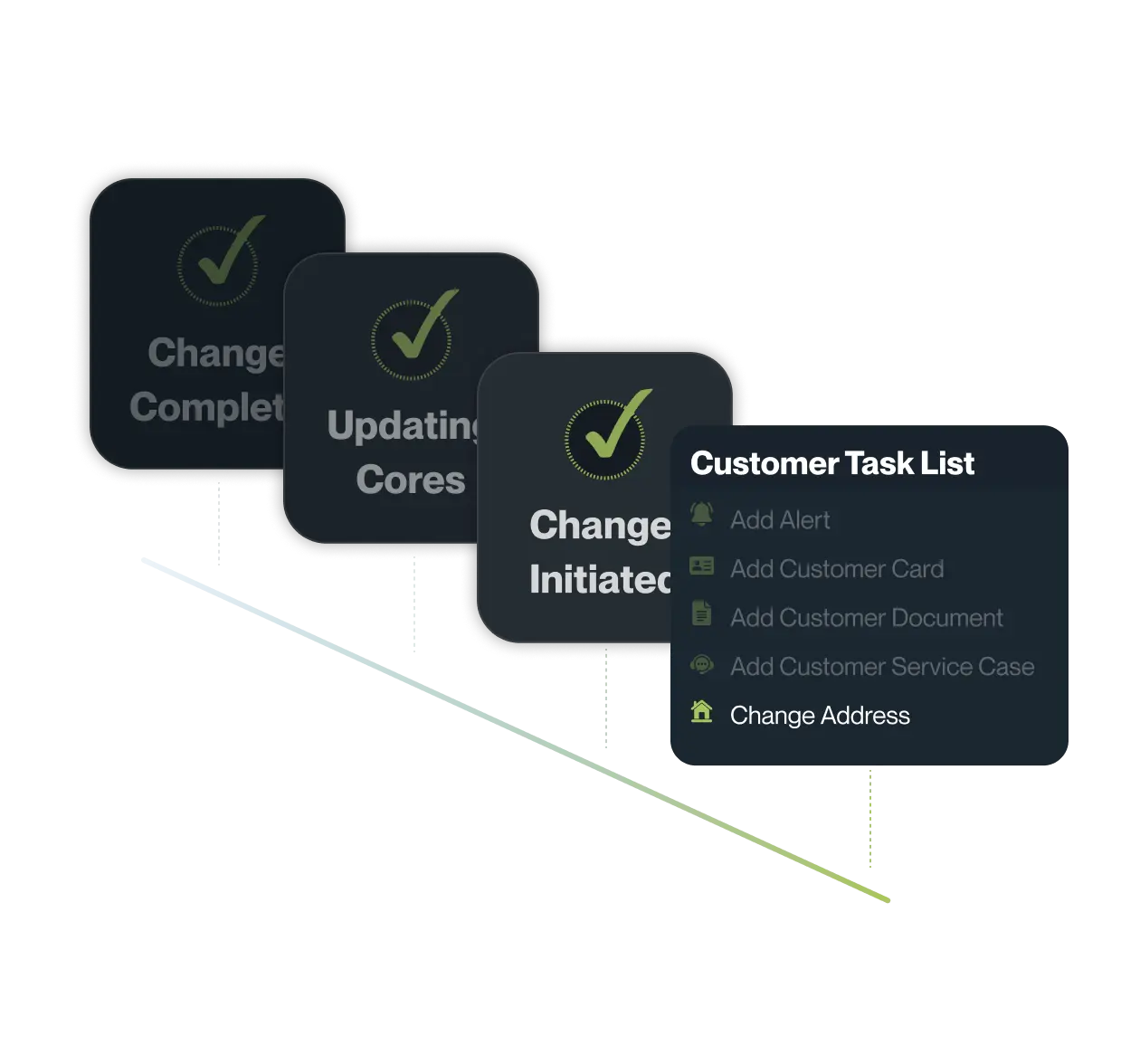

Smarter, Faster Operations

Automate workflows, streamline servicing, and ensure compliance with built-in guardrails and process automation. Remove bottlenecks and free your staff to focus on what matters most: building relationships. From business process management to workflow orchestration and statement generation, every operation runs seamlessly across your institution.

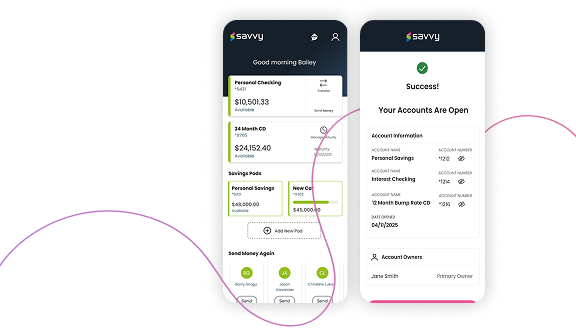

Self-Service Without Limits

Empower customers with modern, intuitive digital banking experiences for both personal and business, powered by an omnichannel banking platform. Whether they’re opening accounts, managing finances, or transitioning to banker-assisted support, every interaction is seamless, consistent, and powered by unified workflows.

The Platform in Action. Choose Your Path.

Savana’s unified banking platform powers two fully connected, purpose-built solutions. One for your bankers and one for your customers. Explore how each one can transform banking experiences for your institution.

Platform FAQs

No. Savana is not a core system. It sits above the core and other systems of record to unify, orchestrate, and expand your bank’s operational capabilities. This enables faster service, greater scale, and more connected channel experiences. By establishing this unified layer, Savana facilitates and supports modernization without a core replacement. The platform is core agnostic and supports operating one Savana instance over multiple cores, reducing the risk of core conversions or transitions.

Both. Savana delivers modern digital banking and account opening experiences while orchestrating internal operations and unifying systems across your institution. We also integrate with third-party tools, giving institutions the freedom to complement Savana with best-of-breed solutions if they choose.

Yes, if you define CRM as a system that provides customer relationship views, interaction history, account management, and case management for service events. Savana delivers all of that, purpose-built for financial institutions. But we also go beyond traditional CRM functionality by unifying all communications, automating workflows, and connecting every channel, product, and supporting technology into one platform.

Unlike standalone ESBs, Savana combines system integration, business logic, and banker-facing workflows in a single platform. It eliminates middleware layers and accelerates implementation by unifying operations from the inside out.

Savana integrates with a wide range of systems, including traditional and modern cores, CRMs, BPM, document storage, call center software, marketing platforms, and AML tools. We support multi-core environments and real-time data flow across your ecosystem.

Yes. Savana is used by sponsor banks and program managers to support BaaS models with multiple fintech partners—enabling centralized operations, servicing, and oversight across brands and relationships.

Yes. Savana supports single or multi-brand institutions. You can manage multiple bank brands from one Savana instance while customizing each brand’s digital experience—ideal for banks undergoing mergers and acquisitions or expanding into new markets with differentiated offerings. Customers get a seamless experience across each brand, whether online, on mobile, or in person—while bankers maintain a single, unified view across all relationships and communications.

No. Savana is modular. You can use specific solutions like Banker Experience or Customer Experience independently or together as a fully unified platform.