Solutions

Savana Banker Experience

One seamless experience bringing together contact center, branch, back office, and assisted account opening, all through a unified end-to-end banking platform.

How Savana Benefits Bankers

Less Time on Systems. More Time with Customers.

Today’s banking customers expect seamless, modern experiences. Disjointed banking systems and manual processes slow service, creating friction between bankers and customers. Savana brings everything together in a connected banking platform built to unify systems, automate workflows, and give bankers the full picture at every touchpoint.

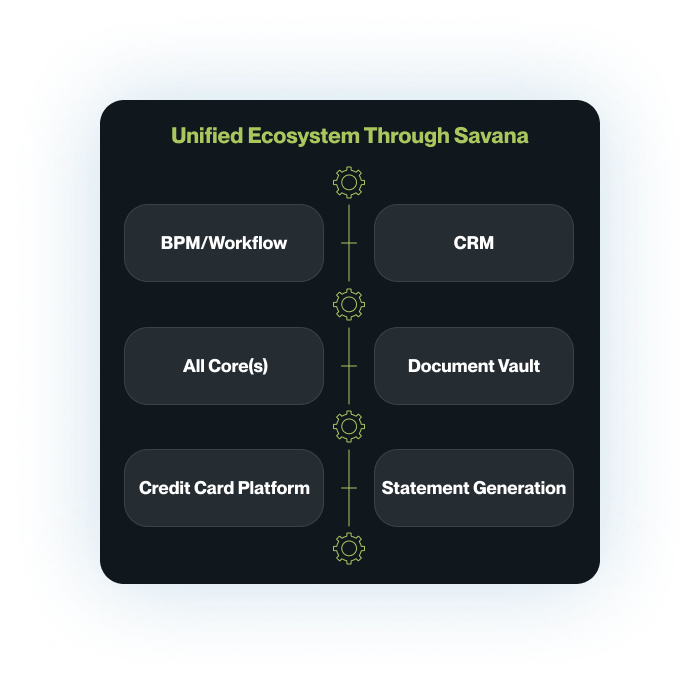

Break Down the Barriers

Unify your banking ecosystem to eliminate silos and improve efficiency.

- Seamlessly connect cores, fintech solutions, CRM, BPM, and third-party integrations.

- Orchestrate across traditional, modern, and multi-core environments.

- Enable real-time data flow across every customer interaction and process.

- Standardize workflows to improve consistency across teams and departments.

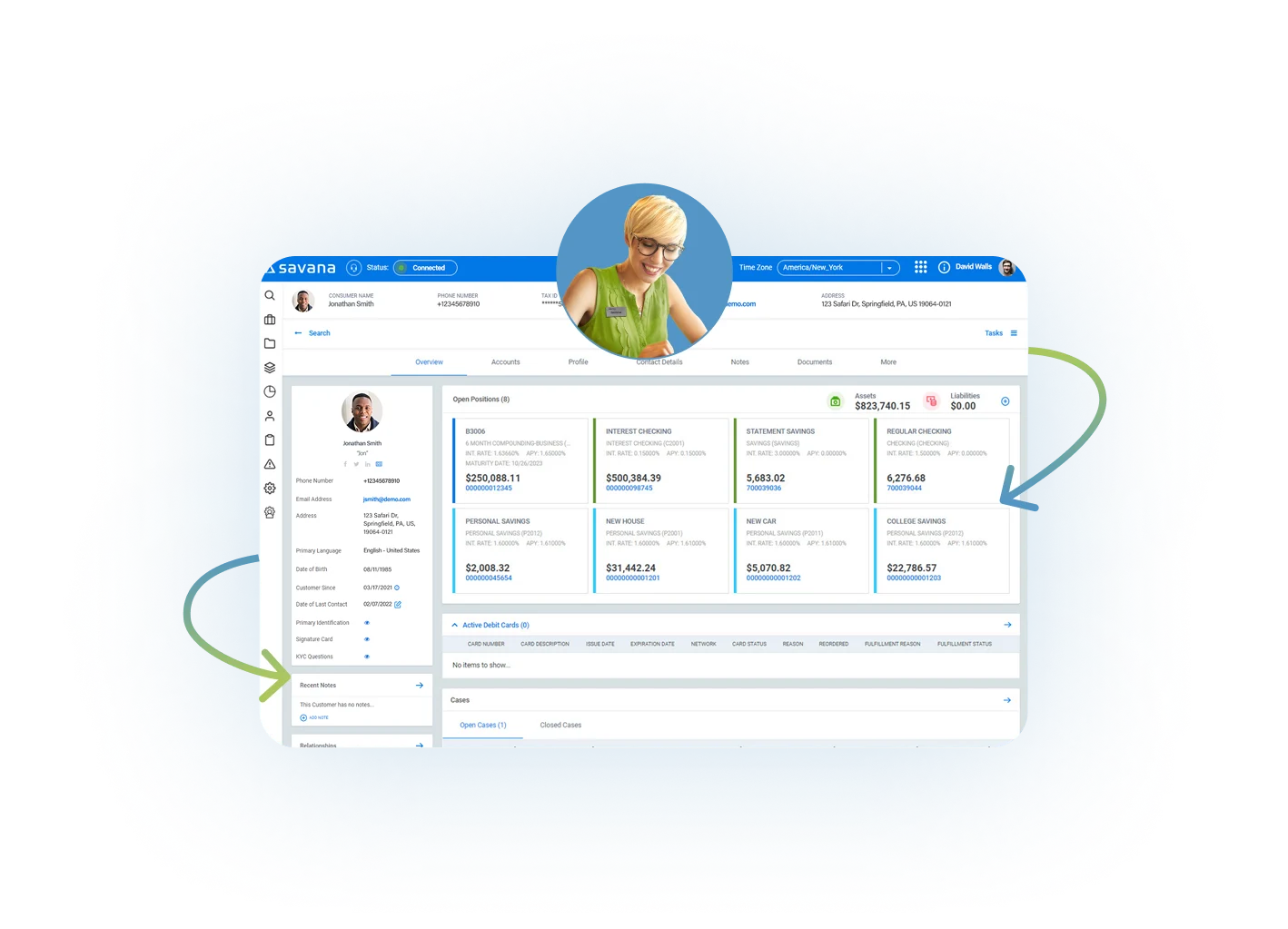

See the Full Picture

Give your team the tools to provide faster, more personalized service with a 360° customer relationship view.

- Access everything in one place. Accounts, cards, communications, and more.

- Eliminate system toggling with complete, real-time customer profiles.

- Reduce time spent searching for information so bankers can focus on service.

- Leverage insights to build deeper, consultative relationships.

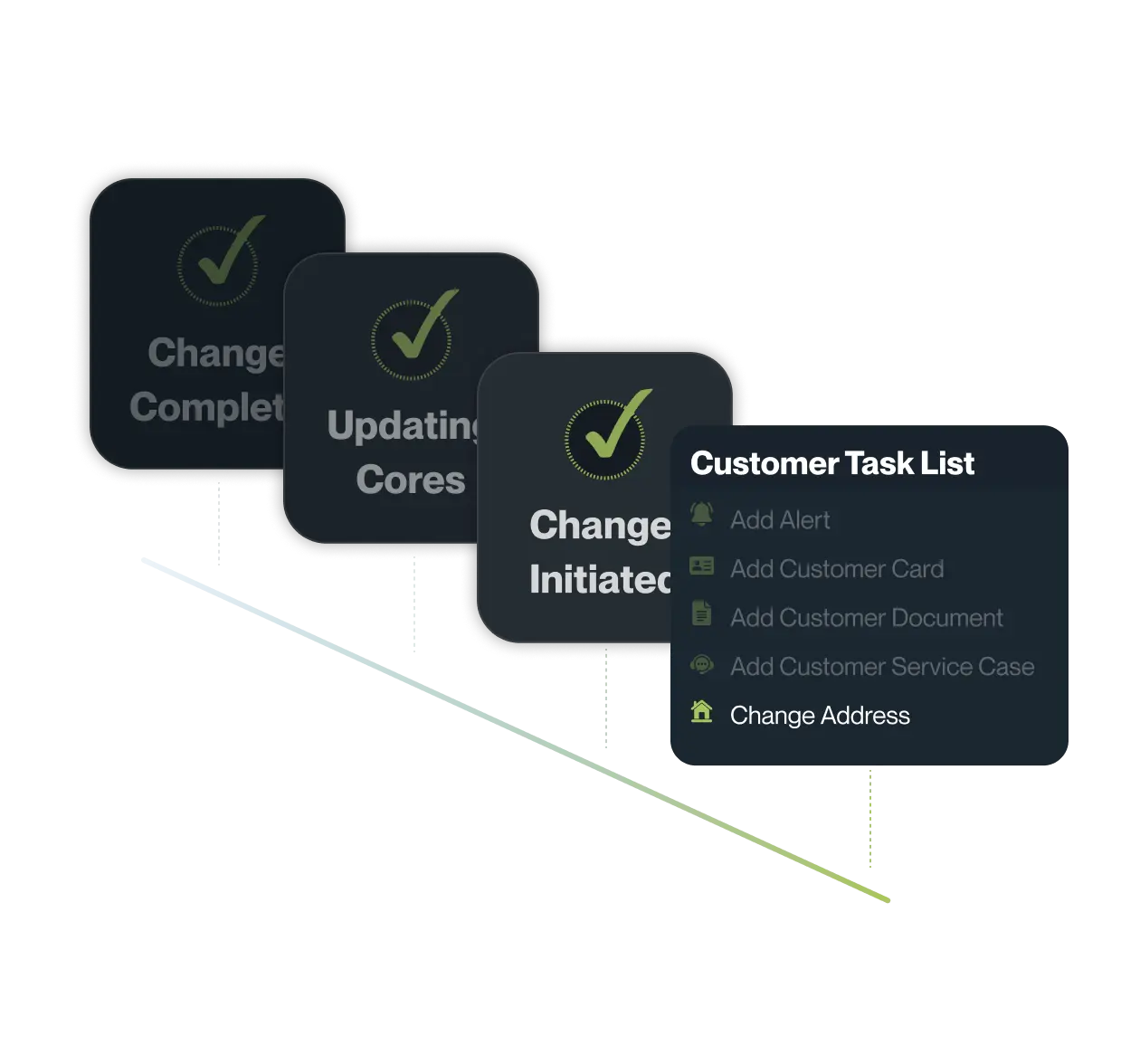

Optimize Operations

Automate and orchestrate banking processes across your institution to free up staff for higher value customer engagement.

- Move faster with 140+ workflows preconfigured to banking best practices, ready to use and easy to modify.

- Reduce manual tasks with intelligent automation that speeds up service.

- Streamline case resolution with pre-built workflows that ensure follow-through.

- Strengthen compliance and risk management with embedded process guardrails.

- Gain real-time visibility into service performance and operational efficiency.

Centralize Communications

Capitalize on a complete suite of customizable tools for streamlining management of all customer interactions, documents, and communications.

- Automate custom notifications and alerts to keep customers informed and engaged.

- Generate and deliver digital and print statements instantly.

- Securely store and retrieve documents with an audit-ready vault.

- Maintain a complete, centralized record of customer interactions and servicing history.

The Banker Experience Ecosystem

Savana seamlessly integrates with the critical technologies banks rely on for core connectivity, customer engagement, compliance, and servicing. By bringing these systems and actions together, banks eliminate silos and ensure every interaction is informed, efficient, and frictionless. Key integrations that enhance the Savana Banker Experience include:

System Connectivity

Core Interface

Unifies traditional, modern, and multi-core environments to provide real-time account and transaction data.

Call Center Management

Integrates with cloud-based call center systems to embed calls into servicing workflows.

Marketing & Pipeline Management

Connects with CRM and marketing tools to enhance customer engagement and drive new business opportunities.

Chat & Co-Browse

Facilitates real-time digital engagement, allowing bankers to guide customers seamlessly through online interactions.

Servicing & Customer Engagement

Statement & Print Mail

Automates statement generation and delivery across both digital and physical channels.

Text & Email Notifications

Keeps customers informed with automated alerts, marketing messages, and servicing updates.

E-Signature

Speeds up approvals and agreement processing with secure, compliant digital signing.

1099 Forms

Simplifies tax reporting with automated generation and distribution of required tax forms.

Money Movement & Transactions

Money Movement

Enables ACH, wires, and other electronic transfers with built-in security controls.

Card Management

Supports debit, credit, and prepaid card issuance and servicing, including activations, spending limits, and dispute management.

Check Ordering

Allows customers to seamlessly request and reorder checks through the online and mobile banking experience.

Compliance, Risk, and Identity Management

KYC/KYB

Accelerates identity verification and compliance processes for both individual and business accounts.

Identity Verification

Enhances fraud prevention with biometric, document, and database-driven authentication methods.

Instant Account Verification

Provides real-time validation of linked accounts, reducing friction in onboarding and transactions.

Banker Experience FAQs

Savana isn’t a traditional CRM or ticketing tool—it’s a unified banker experience platform that connects your core, CRM, BPM, and fintech tools in one interface. It orchestrates workflows and servicing across every channel.

Yes. Role-based permissions let you manage what staff can view, edit, or take action on (including sensitive employee accounts).

Yes. Savana includes case management, workflow automation, and orchestration to eliminate manual processes and ensure consistent service across channels.

Yes. Savana enables seamless, cross-channel account opening, allowing bankers to view, continue, or complete applications started online. All onboarding journeys, documents, and customer data stay synced for a frictionless experience.

Both run on the same unified platform, so your staff and customers interact with the same real-time data and processes. Whether someone starts a conversation online or in the branch, Savana keeps everything connected through Banking APIs.