Solutions

Savana Customer Experience

Modern, secure digital banking and account opening that give your customers more control over their finances, and your bank more control over its brand.

Modern, Secure Digital Banking: Delivered.

Extend the power of Savana’s bank-assisted workflows directly into the hands of your customers. Give customers more control over self-service while your bank gains full control over brand, functionality, and experience. Keep every interaction seamless and connected, whether they’re opening an account, managing finances, or moving to assisted channels for data-informed consultation.

Single Code Base You Control

Maintain feature parity across online banking, mobile banking, and account opening with one code base unifying all self-service experiences.

Your Brand, Your Experience

Customize branding, functionality, and customer journeys with full access to the platform’s source code. Leverage journey analytics to refine the experience for improved engagement.

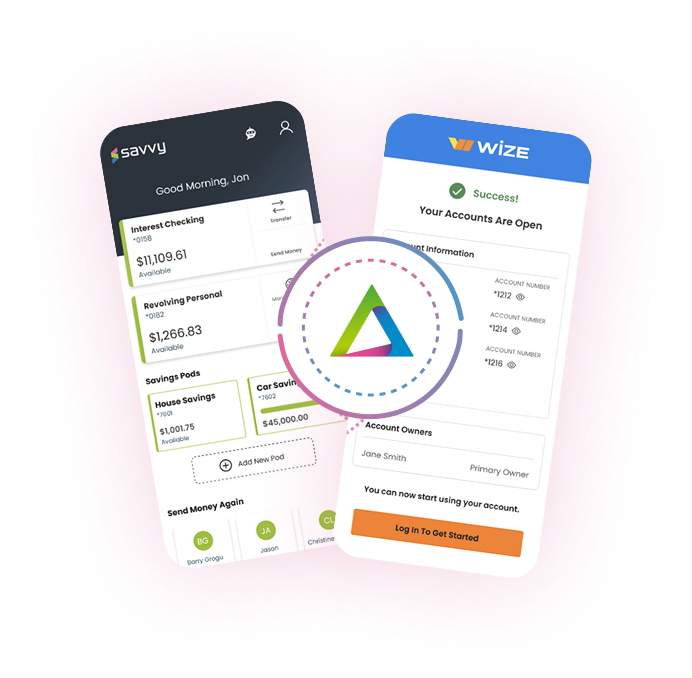

Single or Multi-Brand Banks

Easily launch and manage multiple distinct brands under a single operational model, ensuring unified workflows, processes, customer communications, and more.

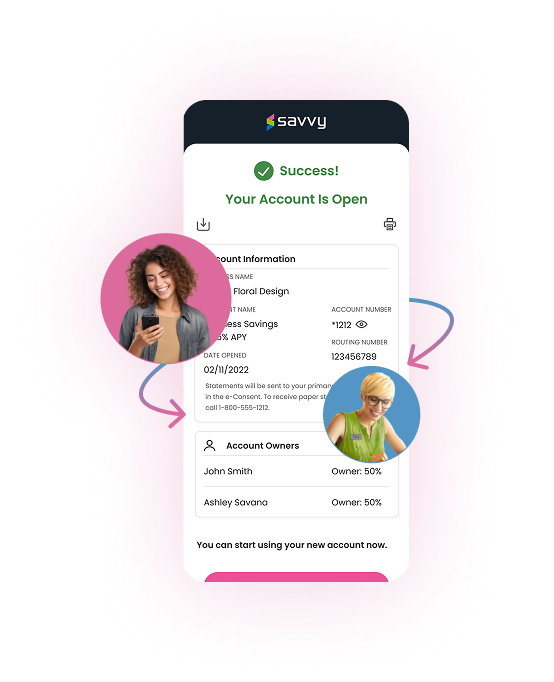

Digital-to-Assisted Channel Fluidity

Bridge the gaps between self-service and assisted banking, enabling seamless movement between digital banking and banker support with full context. Ideal for complex scenarios like multi-party, multi-channel account opening.

Uncompromising Security

Protect every interaction with best-in-class authentication, fraud prevention, and compliance controls to deliver a trusted, frictionless banking experience.

The Customer Experience Ecosystem

Savana integrates with latest solutions that power modern digital banking, including identity verification, payments, account funding, and fraud prevention. With an open, API-first architecture, your bank stays in control while customers enjoy a frictionless experience.

Key integrations that enhance the Savana Customer Experience include:

KYC/KYB

Speed up onboarding with automated identity and business verification, reducing friction for customers while ensuring compliance.

Identity Management Platform (IDP)

Protect customer accounts with secure authentication and seamless access management.

Remote Deposit

Make check deposits effortless with mobile and online capture.

Disclosures & Compliance Forms

Ensure regulatory compliance with automated, timely customer disclosures.

Wire Transfers

Support fast, high-value money movement for business and personal banking.

Person-to-Person (P2P) Payments

Give customers a fast, secure way to send money instantly.

Bill Pay

Simplify money management with built-in bill payment functionality.

Card Management

Empower customers to manage their debit and credit cards, lock, unlock, set limits, and more.

Linked External Accounts

Allow customers to connect and transfer funds between their accounts at different financial institutions.

Instant Account Verification

Verify external accounts in real time for secure funding and seamless onboarding.

Account Funding

Enable seamless deposits and transfers to fund accounts during onboarding and beyond.

Check Ordering

Give customers a simple way to reorder checks without a branch visit.

Customer Experience FAQs

Yes. Savana’s digital banking solution is modular and includes both web and mobile experiences, built on the same code base for consistency. You can deploy it independently as Account Opening only, Online Banking only or as part of the complete Savana platform.

Absolutely. You control branding, design, copy, and customer journeys. With access to a single code base and full source code, you can tailor the experience across web and mobile to control the entire UI look and feel.

Yes. Savana makes it easy to launch and manage multiple brands from a single platform. With a unified code base and full control over branding and content, you can deliver consistent, secure experiences across all your brands without duplicating effort.

Savana supports the opening of all retail and business account types, including checking, savings, IRAs, trusts, joint accounts, and more. The platform is fully configurable to support even the most complex onboarding journeys.

Yes. Savana keeps everything in sync across channels. Whether someone starts onboarding online or calls for help, your staff sees the same real-time data with no gaps or re-entry.